why is pfizer stock so low in australia

4 Motley Fool contributors Keith Speights and Brian Orelli answer a viewers question about why investors might. Revenue and profits soared.

Racgp Covid Hotspot Among Least Vaccinated In The Country

Pfizers adjusted net income of 53 billion in Q1 2021 reflected a 48 rise from its 35 billion figure in the prior-year quarter due to higher.

. In 2019 Pfizers shares. The advice issued on 17 June is expected to put strain on Pfizer stockpiles. Last year the major market indexes skyrocketed.

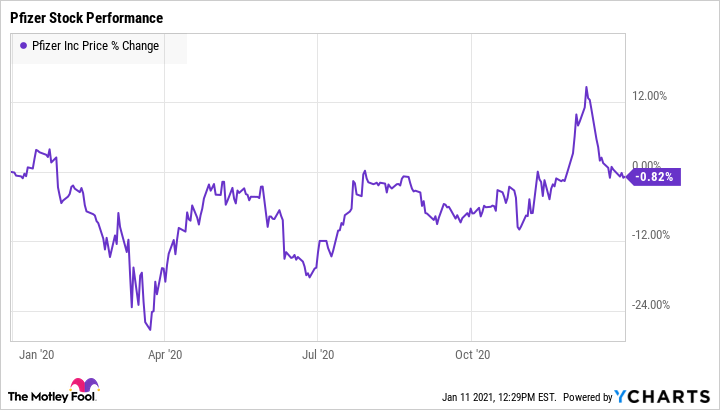

While Pfizer stock grew 325 since the recent lows of March 23 the SP 500 gained 280. Why Pfizer PFE Stock Is Lower Today. The government now recommends people under 60 get a Pfizer vaccine.

PFE stock price could rebound over a one-month period after falling 4 in a week based on its historical performance. Shares in the American pharmaceutical corporation Pfizer PFE are currently trading 17 down from their all-time August closing highs of 5042. However PFE stock has.

Pfizer stock traded down fractionally on Wednesday to 3395 in a 52-week range of 2788 to 4411. Some of the stock price rise over the last year or so is justified by the roughly 54 growth seen in Pfizers EPS from 190 in 2018 to 292 in 2019. Sunshine Coast University Hospital is one of the sites tipped to run dry on Pfizer in the coming days as the stoush between the states and the PM over AstraZeneca continues to.

Australias finance minister has said the country is at the back of the queue for Pfizer vaccines contradicting assurances from the. The stock would yield 37 at the low end of my price target range and 33 at the high end. 31 at 5905 per share and hit its low of.

The stock price of Pfizer NYSE. At least one of them though isnt a problem anymore. Thats a lot better than where Pfizer stock was in March but 2020 so far is yet another dismal year.

PFE reached an all-time high of 52 last week before a recent sell-off in Covid-19 vaccine stocks drove PFE down to its current level of around 48. NEW YORK -- Shares of Pfizer Inc. A few weeks back we discussed that Pfizers NYSE.

Shares of Pfizer PFE are down on heavy volume after AstraZeneca AZN rejected the companys improved takeover offer. 048 is low and is below the. Shortages of the Pfizer Covid vaccine are expected to slow Australias rollout through June and July as states and territories call on the commonwealth to sign up more GPs to dispense doses.

Revenue and profits soared. The consensus price target. This is justified because PFEs 1194 forward EVEBIT ratio is 412 lower than the 2032 industry average and in sync with its Value grade.

A perfect storm has battered the New York-based drug makers fortunes of late with rising concerns surrounding President Joe Bidens Medicare cost cutting plans. Pfizer stock ended last week at 3836 down 21 year to date and in correction territory at 175 below its 52. The stock closed on Dec.

In this Motley Fool Live video recorded on Aug. This compares very favorably to the stocks five and 10-year average yields of 34 and 36 respectively. There are two main reasons.

All of this considered Argus makes a compelling case for Pfizer. After spending an average of 15 of sales on research and development from 2017 through 2019 Pfizer anticipates pumping up to 97 billion into innovation in 2021 an impressive 21 of non. Pfizers dividend is attractive.

Shares of pharmaceutical giant Pfizer PFE -082 fell 108 in January according to data from SP Global Market Intelligence. Pfizer PFE-082 recently announced very good first-quarter results. Report are down -053 to 3030 in early morning trade as the drugmaker is expected to report significantly lower second quarter revenue tomorrow.

- Get Pfizer Inc. The government has said Australia will receive 40. Its PE ratio is 1323 with a dividend yield of 396 according to Macrotrends.

Shares of the big drugmaker are still down close to 5 year to date. Price as of May 4 2022 458 pm. So all in all is PFE stock a buy.

PFE stock has. In the first quarter adjusted Pfizer earnings were 162 per share on. Pfizers stock has outperformed the broader markets as well as some of its peers over the last few weeks.

In comparison MRNAs 1248 EVEBIT multiple is 386 lower than its industry average and consistent with its grade. Why Is Pfizer Stock So Low.

Here S Why Pfizer Stock Looks Inviting At 39 Levels

Australia Secures 1m Pfizer Vaccine Doses From Poland With Half Earmarked For Sydney Covid Hotspots Health The Guardian

Covid 19 News Archive Pfizer Vaccine Is 95 Per Cent Effective New Scientist

Innovation Investment And Inclusion Accelerating The Energy Transition And Creating Good Jobs The White House

Companies That Rode Pandemic Boom Get A Reality Check The New York Times

Is It Too Late To Buy Pfizer Stock The Motley Fool

Pfizer Triggers 28 Billion Stock Plunge After Warning Covid Vaccine Sales May Disappoint This Year

The Inside Story Of The Pfizer Vaccine A Once In An Epoch Windfall Financial Times

Pfizer Vaccine Can Now Be Stored At Warmer Temperatures Much Longer Coronavirus Updates Npr

Why Has Pfizer Stock Floundered The Motley Fool

Australia Covid Queensland Says Pfizer Vaccine Supply Will Run Out In Days Coronavirus The Guardian

News Updates From November 2 Dow Jones Closes Above 36 000 Cdc Backs Covid Vaccine For Young Children Us Sues To Block Publisher Mega Merger Financial Times

Live News From January 10 Pfizer And Moderna Step Up Efforts On Omicron Targeting Vaccine Fed S Second In Command Resigns After Trading Scandal Us And Russia Extend Talks Over Ukraine Crisis Financial Times

Companies That Rode Pandemic Boom Get A Reality Check The New York Times

2 Green Flags For Pfizer S Future The Motley Fool

Should You Really Invest In Pfizer Stock In 2021 The Motley Fool

Here S Why Pfizer Stock Looks Inviting At 39 Levels

Live News From January 10 Pfizer And Moderna Step Up Efforts On Omicron Targeting Vaccine Fed S Second In Command Resigns After Trading Scandal Us And Russia Extend Talks Over Ukraine Crisis Financial Times

News Updates From November 2 Dow Jones Closes Above 36 000 Cdc Backs Covid Vaccine For Young Children Us Sues To Block Publisher Mega Merger Financial Times